Waypoint Monthly Commentary

All Weather Alternative Fund Commentary

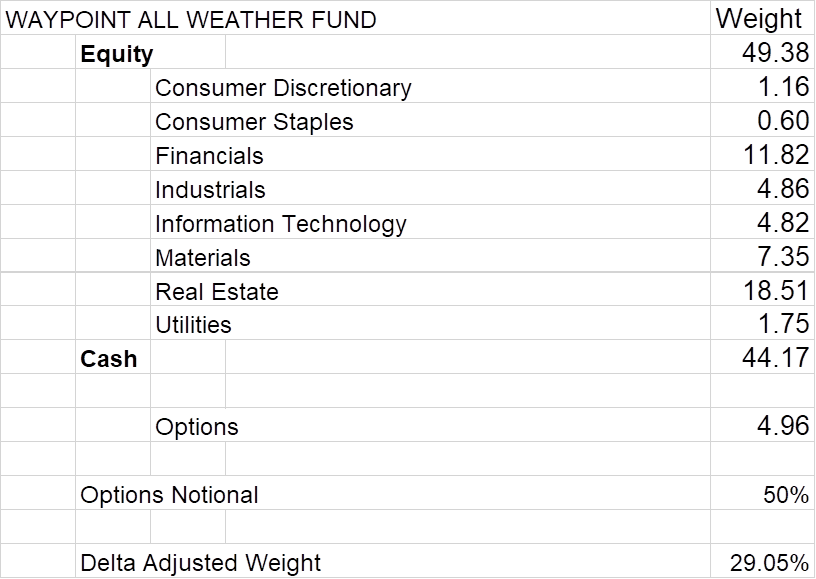

The Waypoint All Weather Strategy is our core public equity portfolio that is designed to deliver superior risk adjusted returns across market cycles. It is comprised of capital distributors and compounders with a put option overlay to reduce the impact of market drawdowns.

2023 Monthly Commentaries

- February

- January

The All-Weather Alternative Fund was +1.62% (+1.50 YTD) in February vs. -2.45% (+4.78% YTD) for the S&P TSX Total Return Index. Equity markets sold off in the later half of the month following a stronger than expected PPI and continued resilience in economic data. Rate expectations moved higher in February with markets now discounting peak FED funds at 5.47% in September versus 4.91% at the beginning of the month.

The fund benefited considerably from a mark-to-market increase in our options positions. This was offset slightly by weakness in our industrial names.

Quarterly earnings season is well underway, and we are starting to see things change on the margin. Household leverage has been increasing for a long time and this higher rate environment is starting to bring down the consumers capacity for discretionary consumption.

The portfolio continues to be concentrated in our highest conviction names and we continue to be positioned net short with our in-the-money options position. We thank you for your ongoing support.

The All-Weather Alternative Fund was -0.12% vs. +7.40% for the S&P TSX Total Return Index for the month of January.

Equity markets had one of their strongest starts to the year as inflation measures continued to slow and economic activity metrics held up. The narrative swung further in favour of a soft landing leading to increased speculation by market participants. Although all sectors where in the green, North American equity returns were led largely by long-duration growth equities. Shopify was the best performing stock inthe TSX posting a 39.5% return in the month. A rise in speculation can be further evidenced by the historical record in daily option volume, which occurred on Feb 1st. Furthermore, an alarming number of these options are “zero day to expiry” suggesting blatant gambling by retail investors.

The largest contributors to this month’s return in the Fund were AirBossof America, which was up over 46% and PayfareInc., which was up 33.8%. Given the market strength, this strong equity performance was offset but the mark-to-market decline in our in-the-money options positions.

We have concentrated the portfolio in our highest conviction names and continue to carry a net short position. We believe that increased interest rates have yet to percolate through the economy and now is a time to take caution. We thank you for your ongoing support.

2022 Monthly Commentaries

- December

- November

- October

- September

- August

- July

- June

- May

- April

- March

- February

- January

The All-Weather Alternative Fund was +3.78% (-8.20% YTD) vs. -4.90% (-5.84% YTD) for the S&P TSX Total Return Index for the month of December. Downside volatility persisted as monetary authorities reaffirmed their commitment to fight inflation with increasingly tight monetary policy. The Fund’s long volatility position provided significant positive contribution in December offset slightly by losses in our equity positions.

Going forward, the crucial test won’t be how far central banks hike rates but how long they hold them at elevated levels. From our perspective, market participants remain largely complacent hoping for a near-term pivot. We believe this will occur long after significant damage is already done and borrowers both on the consumer level and corporate sector work through massive amounts of debt set to roll at significantly higher rates.

We continue to maintain a large negative delta position through our in-the-money option exposure. We thank you for your continued support.

The All-Weather Alternative Fund was +0.68% (-11.55% YTD) vs. +5.54% (-0.99% YTD) for the S&P TSX Total Return Index for the month of November.

Markets remain volatile following CPI numbers and commentary from monetary authorities around the pace and cadence of rate hikes. Contribution from the fund’s long volatility position largely offset strong gains in our equities.

The economic backdrop continues to deteriorate as evidenced by rising unemployment and weak Real Estate market data. We have taken the opportunity to concentrate the fund around our highest conviction equity names while maintaining a large negative delta through our in-the-money option exposure. We thank you for your continued support.

The All Weather Alternative Fund was -5.28% (-12.15% YTD) vs. +5.57% (-6.19% YTD) for the S&P TSX Total Return Index.

The Fund’s derivative positions largely drove the negative performance in the month after markets made a decisive move higher following the Bank of England’s decision to buy government bonds and bail out pension funds running LDI strategies in mid-October. The dovish narrative that monetary authorities would step down rate hikes and even “pivot” was further strengthened after the Bank of Canada raised rates 50 bps when the market was expecting 75 bps.

This was a particularly difficult month for the strategy as our equity positions also contributed to the negative fund performance while broad indexes were strong. With that said, we remain confident in the positioning of the portfolio going into year end. The labour market remains very tight and there continues to be strong underlying demand suggesting the Fed has a way to go to win its fight against persistent inflation. More recently, we have begun to take advantage of compelling valuations for our high conviction names and added to these names.

The All Weather Alternative Fund was -1.69% (-7.25% YTD) vs. -4.26% (-11.14% YTD) for the S&P TSX Total Return Index.

The negative performance of two names, AirBoss of America and NEO Performance Materials more than offset the positive contributions from our derivatives positions. The companies trade well below our estimate of intrinsic value, and we view these as an excellent opportunity.

Macro variables such as a commodity prices, currencies and bond yields continued to trend in the month of September indicating bearish sentiment whereas equity markets continue to be range bound in stark contrast. We are particularly surprised by the strength of the financial sector given the likely impact of rising rates on the consumer, slowing loan growth, and increases in delinquency levels.

The Fund is currently positioned ~15% net short with the longer duration option positions in the money.

The All Weather Alternative Fund was -0.59% (-5.66% YTD) vs. -1.61% (-7.19% YTD) for the S&P TSX Total Return Index.

Any enthusiasm in the first half of the month from signs of a lower inflation trend was quickly dampened by Jerome Powell’s speech at Jackson Hole. “We will keep at it until we are confident the job is done” effectively pulled back any hope of a potential FED pivot signaling a restrictive policy stance for some time to come.

The All Weather Fund behaved largely as expected in the month with the longer tenor volatility positions acting as a ballast to the equity book. As mentioned, the current environment is well suited for a long volatility strategy. The combination of higher interest rates, higher dividend yields and the return of the volatility risk premium allows one to construct a portfolio targeting a return profile close to 10% entirely absent of market direction.

The All Weather Alternative Fund was +1.20% (-5.20% YTD) vs. +4.65% (-5.67% YTD) for the S&P TSX Total Return Index.

The trend has finally broken and it appears that we are going to see sustained volatility in equity markets. Across all asset classes and sectors, we witnessed negative short-term technicals in the second quarter with all having found support at their 200-week moving averages.

Strength in the second half of July came on the back of better-than-anticipated corporate earnings and the market’s belief that the Fed has pivoted from an uber hawkish tone to one that is a bit dovish. However, robust job growth and low unemployment combined with a supply chain that continues to be stretched increases the risk that inflation remains persistently high without continued rate hikes.

This current environment is well suited for a long volatility strategy. The combination of higher interest rates, higher dividend yields and the return of the volatility risk premium allows one to construct a portfolio targeting a return profile close to 10% entirely absent of market direction.

The All Weather Alternative Fund was +1.83% (-6.23% YTD) vs. -8.71% (-9.87% YTD) for the S&P TSX Total Return Index.

A strong inflation print in June solidified the aggressive tightening path taken by monetary authorities leading to losses across all sectors of the TSX. The fund was able to take advantage of this drawdown and monetize a short-dated volatility position leading to positive returns for the month.

Although multiples have contracted to more reasonable levels, we have yet to see meaningful changes to forward earnings expectations. We believe markets will continue to be range bound as the tug-of-war plays out between the current resilience of corporate fundamentals and higher rates, ongoing supply shocks, and rising input costs. The fund is well positioned to take advantage of the current environment.

The All Weather Alternative Fund was -3.26% (-7.92% YTD) vs. 0.06% (-1.27% YTD) for the S&P TSX Total Return Index.

Continued strength in the energy sector where the Fund does not have exposure and weakness in one of our holdings, AirBoss of America, accounted for the difference in performance for May.

During the month, monetary authorities continued down the path of normalization with the Bank of Canada increasing its target for the overnight rate to 1.5%. The policy statement pointed to an economy operating in excess demand with elevated job vacancies, robust consumer spending and the rising risk of elevated inflation becoming more entrenched.

If one were to look to history for perspective, nine times since 1961, authorities have embarked on a series of interest rate increases to rein in inflation. Eight times a recession followed. It is our firm belief that this occasion will not be the second outlier.

The All Weather Alternative Fund was -2.22% (-4.81% YTD) vs. -4.96% (-1.33% YTD) for the S&P TSX Total Return Index.

The Fund’s derivatives positions were a positive ballast in the month; however, our individual equity positions underperformed the broader index – largely affected by weakness in our financial and cyclical names.

The Fund is currently positioned ~15% net short with the longer duration option positions in the money. The Fund exited the month positioned to make money for clients upon further market weakness.

The All Weather Alternative Fund was -0.10% (-2.65% YTD) vs. +3.87% (+3.67% YTD) for the S&P TSX Total Return Index.

Strength in the Fund’s equity positions was offset by mark-to-market declines in volatility positions as the overall index rebounded in the month.

As central bankers further signal their intention to tighten financial conditions, we are witnessing a disconnect between fixed income and equity markets. Interest rate volatility has increased significantly while equity market reactions have remained muted. The Fund continues to maintain its defensive stance and is well positioned to take advantage of any dislocations in equity markets.

The All Weather Alternative Fund was -0.76% (-2.55% YTD) vs. 0.28% (-0.13% YTD) for the S&P TSX Total Return Index.

Strength in energy and materials accounted for the difference in performance as the Fund is underweight these sectors relative to the benchmark. Although rising commodity prices appear to be positive for the Canadian economy at first glance; the negative effects on consumer spending and increased pressure on monetary authorities to accelerate rate hikes will prove to be detrimental for economic growth and put downward pressure on asset prices.

Year-to-date, the S&P TSX has appeared to dissociate from the negative performance exhibited by many indices globally. We do not believe this can continue for an extended period – decoupling theses’ have failed every single time when analyzed in a historical context.

The Waypoint All Weather Alternative Fund was -1.81% in January vs. -0.41% for the S&P TSX Total Return Index.

As the month began, we saw early indications of markets reacting to the prospect of policy normalization in the face of continued economic strength and persistent inflationary pressures. However, January ended with the S&P TSX relatively unchanged due to market complacency that policy makers would once again pivot their tightening intentions like they have in the past four years.

The Fund’s derivatives positions were largely flat in the month; however, our individual equity positions underperformed the broader index – largely affected by weakness in our cyclical names.

If, like us, you believe we are on a path to policy normalization – the All Weather Alternative Fund will be a benefit to your asset mix as it is well positioned to take advantage of increasingly volatile markets.

2021 Monthly Commentaries

- December

- November

- October

- September

- August

- July

- June

- May

- April

- March

- February

- January

The Waypoint All Weather Alternative Fund was +0.46% in December (+0.92% YTD) vs. 4.04% for the S&P TSX Total Return Index.

2021 was a difficult year for the Waypoint All Weather Alternative Fund. The persistent strength in equity markets eroded our options positions consistently throughout the back half of the year while our individual equity positions underperformed the broader index, which was driven primarily by energy and banks. These are sectors that the All Weather Fund under-allocates to.

We were too defensive in light of the record monetary and fiscal stimulus, which contributed to excessive amounts of liquidity and drove asset prices. Entering 2022, we are already seeing the consequences of decisions made in past years with inflation gauges reaching levels not seen in several decades. Central banks across the world are pointing to monetary tightening – thereby driving liquidity out of the system.

Last week, we witnessed 30-year US bonds decline -9.35% on a total return basis. This is the worst calendar week in the 49 years of data – if it was a year, this would be the fifth worst. It appears the bond market is now realizing that Fed liquidity is coming to an end.

To date, the stock market has not responded this monetary pivot, but we believe history demonstrates that financial markets rarely dislocate from each other over extended periods of time. The Fund has carried its defensive stance into the beginning of 2022.

The Waypoint All Weather Fund was up 1.42% in November (+1.11% YTD) vs. -1.62% for the S&P TSX Total Return Index.

Fund performance was largely attributed to the strength of our options positions and offset slightly by weakness in our Industrial and Real Estate holdings. Hawkish comments from the Fed and uncertainty over the new Omicron variant led to increased volatility in equity markets in the last week of the month.

The All Weather Alternative Fund ended the month with substantial downside protection, extending into 2023.

The Fund is positioned to take advantage of further market weakness should it arise.

The Waypoint All Weather Alternative Fund was -1.20% in October (-0.31% YTD) vs. +5.02% for the S&P TSX TR.

Performance was negatively affected by a mark to market decline in our options portfolio as equities continued to grind higher during the month.

The portfolio is well positioned to take advantage of a rise in volatility – currently becoming more evident in the bond market but largely absent in equity markets.

The Waypoint All Weather Fund was -1.42% in September (+0.90% YTD) vs. -2.3% for the S&P TSX TR. As mentioned in our previous commentary, we have begun to see an increasing number of analyst downgrades and strategist reduce their recommended exposure to equities. Mounting issues associated with supply chain disfunction, inflation concerns and rising energy prices have begun to impact economic momentum. At the same time, several economic policy decisions, including central bank asset purchase tapering and debate over the debt ceiling limit, are impacting investor confidence.

We have been writing about these issues for several months and believe Q4 is likely to be a more volatile period for equity markets. The All Weather Alternative Fund has taken an increasingly defensive stance throughout this period to provide capital protection for unitholders. A precipitous decline in volatility throughout the year has led to mark-to-market declines in our long-dated options positions. However, we must remind investors that pricing can quickly reverse alongside rising volatility and market draw downs. We therefore believe this is an opportune time for investors to gain exposure to long volatility through the All Weather Alternative Fund ahead of Q4 events.

Several of the All Weather portfolio companies reported during the month of August. Of note were the results of Air Boss, Intertape Polymer and Pet Value –all of which demonstrated strong earnings results and positive outlooks for the remainder of the year.Industrial end markets have continued to prosper as evidenced by solid operating margins, low levels of inventory and short lead times.Despite these strong fundamentals, stocks have not performed as concerns around the transitory nature of this strength continue to dominate expectations for the 2ndhalf of 2021.Pet Value reported its first quarter in August returning to the universe of public companies. Results were robust, demonstrating the effectiveness of their business model and end market growth.

Volatility was once again muted in the month leading to a significant decline in realized volatility measures.The month ended with realized volatility at its lows while implied volatility in the options market rose slightly in the month.Forward measures reflect investor expectations of a more unstable end to 2021.Strategists have begun to challenge GDP growth expectations, citing downward revisions as well as identifying the risks of central bank asset tapering.

The All Weather Alternative Fund ended the month with substantial downside protection, extending into the new year.The Fund is positioned to take advantage of market weakness should it arise.

The All Weather Alternative Fund was down -2.88% for the month versus +0.80% for the S&P TSX TR.

Equity performance was negatively impacted by the fund’s exposure to Industrials, Financials and Real Estate which, collectively, contributed -1.3%.

Our options positions were marked down due to a decline in volatility in the month. Volatility, across the volatility surface (term structure & moneyness) reached a low for the year in July – rapidly declining since May. Our current positioning is designed to take advantage of material market moves (up or down). In contrast, the market has been flat since the beginning of June.

Our position, to take advantage of upside market moves, is 1% out of the money. Therefore, a material rise in equities – which could be due to increased earnings momentum, expansionary economic policy initiatives or general economic strength – will benefit portfolio performance.

On the downside, the portfolio is fully insured from a market pull back or material decline. This position is primarily responsible for the mark-to-market loss in our options position for the month (and generally from May – July).

We are concerned that the economic momentum we have experienced in the first half of 2021 will decline in the second half of the year. Factors such as inflation, declining earnings momentum, supply chain constraints, extreme levels of debt and general geopolitical tensions contribute to our defensive positioning.

We remained disciplined with our approach to the volatility asset class and confident in our positioning.

The All Weather Alternative Fund was up 0.96% for the month versus +2.48% for the S&P TSX TR. Contributions to this month’s performance largely came from the fund’s Real Estate and Financial exposures.

As the S&P TSX continued to drift higher, 10-year yields dropped to levels we have not seen since mid-February suggesting that the bond market is signaling recent inflationary pressures might be transitory.

We have not made significant changes to the fund’s volatility position in the month and are well positioned for what we believe could be a more challenging second half of the year.

The AWF had a challenging month, down 2.9% versus the S&P/TSX TR up 3.4%. Contributing to the month’s decline was a -2.0% mark-to-market on the funds volatility position and a 20% decline in the price of Airboss of America Corp (TSE: BOS).

Waypoint has maintained a position in Airboss for several years and we maintain our belief that the company owns unique assets that are both valuable and difficult to replicate. Throughout the pandemic Airboss was able to secure a government contract for protective equipment used to assist front-line workers. This provided the company a meaningful boost in profitability and cash flows throughout that period. Going forward, we acknowledge that last year’s results are not easily replicated however, our fundamental view of value stems from the company’s core operations in rubber compounding in addition to opportunities for incremental defense business. Rubber compounding facilities remain scarce and proximity to end markets provides a sustainable competitive advantage. We believe the recent volatility in the stock is an opportunity for investors.

The S&P/TSX has maintained its positive drift higher since the beginning of January. As a result of last month’s strength, realized volatility fell to its lowest level of the year (8.8 versus its 13.8 in March and April). We made the decision to increase our volatility position significantly in the month of May as a result of the strong year to date equity performance and the relative pricing of protection. Exiting the month, we have extended our position to the end of the year which now accounts for 2.5% of the portfolio’s NAV.

The All Weather Alternative Fund was up 1.86% for the month (+6.85% YTD) compared to +2.39% (+10.63% YTD) for the S&P TSX Total Return Index.

Strength in the strategy’s financial positions was slightly offset by erosion in the volatility position of the overall index.

We continue to position the strategy to take advantage of both upside and downside volatility.

The Waypoint All Weather Strategy was up 3.7% for the month (+6.2% YTD) compared to +3.8% (+8.1% YTD) for the S&P TSX Total Return Index.

Strength in the strategy’s equity positions was slightly offset by erosion in the volatility position of the overall index. The strategy has approximately 30% equity exposure at current levels. A notable contributor to performance in the month was a core position in AirBoss of America. AirBoss announced a large contract award with the US Department of Health and Human Services (HHS) for the sale of nitrile patient examination gloves. Subsequent to the announcement, the shares have more than doubled.

We continue to position the strategy to take advantage of both upside and downside volatility.

The Waypoint All Weather Strategy was up 1.8% for the month compared to +4.3% for the S&P TSX Total Return Index.

Strength in Financial, Information Technology and Real Estate names were offset by erosion in the volatility position on the overall index.

We continue to position the strategy with the expectation of increased volatility going forward -both on the upside and downside.

The Waypoint All Weather Strategy was up 0.6% for the month compared to -0.3% for the S&P TSX Total Return Index.

One notable contributor to our positive performance in the month was our core position in VersaBank. VersaBank is Canadian Schedule 1 bank that operates a highly efficient, low-risk branchless partnership model. This model has allowed VersaBank to establish industry leading net interest margins, industry leading provisions for credit losses and compound core cash earnings over the past 6 years at 31%.

We continue to position the strategy with the expectation of increased volatility going forward.

2020 Monthly Commentaries

- December

- November

- October

- September

- August

- July

- June

- May

- April

- March

- February

- January

The Waypoint All Weather Strategy was up 1.9% for the month (+17.6% YTD) compared to 1.72% (+ 5.6% YTD) for the S&P TSX Total Return Index.

No material changes were made to the portfolio in the month of December. Entering 2021, we see signs of euphoria in certain sectors of North American equity markets where price and fundamentals have significantly diverged. We have continued to increase our weightings in businesses where our conviction is the highest and where price does not reflect positive and improving underlying business fundamentals.

Much like we have experienced over the last three years – we expect equity market volatility to remain elevated. Particularly with large market drawdowns followed by policy intervention leading to market recoveries. Our options portfolio is positioned to profit from this market behaviour.

The Waypoint All Weather Strategy was up 3.8% for the month (+15.4% YTD) compared to 9.75% (+3.8% YTD) for the S&P TSX Total Return Index. The month of November was one of the strongest on record for the Canadian market.

The strategy benefited from an increased allocation to REITs throughout the month, offset by our volatility options strategies. The allocation to the REIT sector increased materially in November given the compelling risk vs. reward characteristics offered by best in class operators; in addition, the allocation has significantly increased the overall yield generated by the strategy.

We continued to deploy our volatility strategies throughout the month with a particular emphasis on downside protection.

The Waypoint All Weather Strategy was flat for the month (+11.2% YTD) compared to -3.5% (-6.1%) for the S&P/TSX Total Return Index. The Strategy performed as expected with our options positions benefitting from increased volatility in the last week of the month leading up to the U.S. Election. In October, we increased our allocation to what we believe to be best in class Real Estate Investment Trusts.

Although there is still uncertainty as to which candidate will ultimately win the U.S. election, the closer than expected results can been viewed positively as a sign that big sweeping legislative changes and near term tax increases are less likely.

Market volatility will continue in coming months and we feel we are well positioned to protect and prudently compound investor capital.

The Canadian market ended September down 2% for the month, after 5 consecutive months of strength following the March sell-off. The drivers of weakness included the energy, financial and materials sectors while staples, industrial and utilities produced positive results. The financials sector in Canada continues to work through deferral activity offered earlier this year. September marked the first month of a return to normal payments for many customers who were provided accommodation at the peak of the COVID crisis. Given this backdrop, we expect the financial sector to remain a “show-me story” for the remainder of 2020.

As we get closer to the election period in the US, we have taken steps to further reduce portfolio risk. Additionally, we expect that the end of the summer season to make it incrementally more difficult for businesses to remain open (servicing clients). Lastly, negotiations currently taking place to extend social programs are likely to result in market volatility. Accordingly we have increased our exposure to volatility instruments in anticipation of these risks.

Since hitting previous highs on February 19th, 2020, North American indexes fell 30‐37% in 23 trading sessions only to rebound aggressively on the back of significant monetary easing from central banks. After six months and over four trillion dollars of issuance from the Treasury, a passive investor with exposures to US equities is no worse for wear. Large cap technology stocks have been the primary beneficiary of liquidity with the NASDAQ up over 31% YTD and the S&P 500 also positive for the year

In Canada, we have started to see investor demand spill over into mid‐small cap equities. The Waypoint All Weather Strategy has benefitted from its 30% exposure to this sub‐segment. Our largest position remains AirBoss of America (BOS) which has benefitted from improved fundamentals as governments continue to procure much needed supplies for frontline healthcare workers. Our equity positions in the portfolio remain diversified amongst the GICS sectors with no one sector accounting for more than 15% of the portfolio.

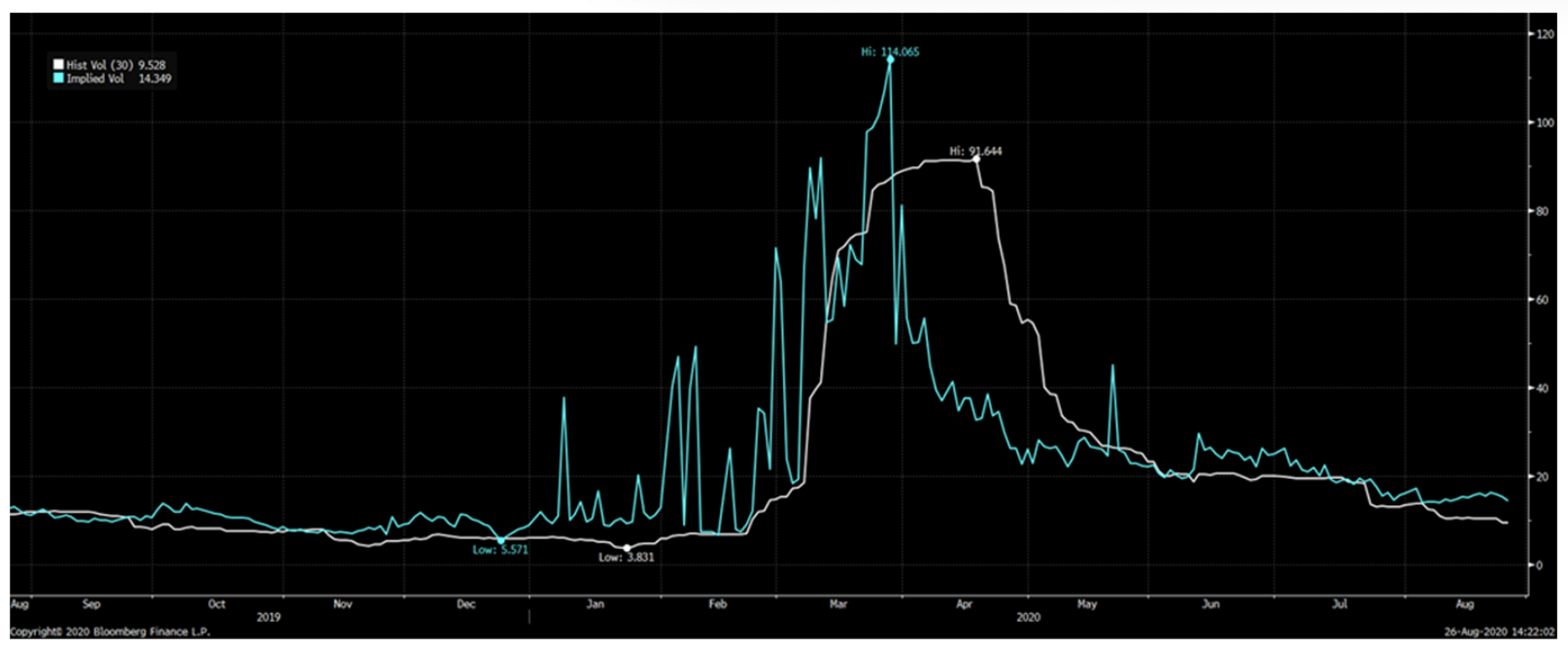

The options markets in Canada continue to forecast elevated levels of risk after the equity declines in March. A low for volatility occurred in January of 2020, months before the March sell‐off. For the past two years, options volatility has been extraordinarily low and is currently 3 points higher than a typical market average of 15 to 16. Currently it is almost double the level witnessed in the last two to three years.

The March sell‐off changed the dynamic of “short volatility” strategies by reducing the appetite for Put selling. Instead, Call selling has dominated the market resulting in underpriced Calls and overpriced Puts. At its peak, the options skew was at a 10 year high. Skew trades remain the most attractive in the Canadian market allowing investors to fund upside with considerable downside protection at zero cost. Specifically, the Canadian banks offer the most compelling exposure given the strong investor appetite to overwrite on these positions.

Third quarter bank earnings are coming in better across the board. Although still elevated from prior years, loan loss provisions and deferrals are declining quarter over quarter. It is evident that government programs have had significant influence on the Canadian consumers’ ability to meet their obligations. With approximately $260 billion of consumer loans in Canada still in deferral, further government support will be instrumental as the economy continues to re‐open.

Despite higher levels of volatility than observed prior to March 2020, options pricing relative to dividend yields in our equity universe is attractive. We are beginning to increase our gross exposure, taking advantage of dividend funded protection.

With investors benefiting from a recent rise in asset prices – we believe that now, more than ever, is a good time for those looking to protect their capital and prudently compound over time to consider the Waypoint All Weather Strategy.

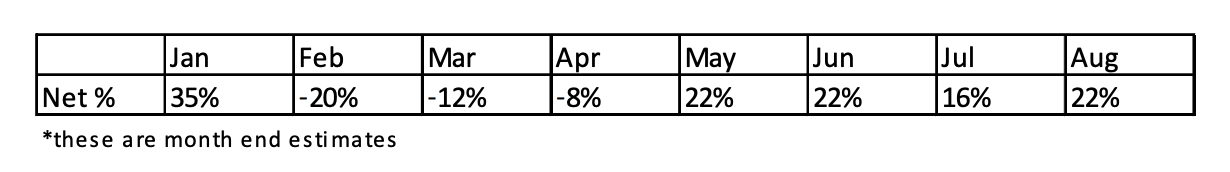

All‐Weather Strategy Net Exposure

XIU Index Vol (Hist & Implied)

The Waypoint All Weather Strategy was up an estimated 1.9% (+11.1% YTD), compared to 4.5% (-3.3% YTD) for the S&P TSX total return. We have witnessed continued momentum in equity markets in the month on the back of accommodative commentary from Central Banks. Precious metals companies have led index returns in the Canadian markets as gold touched all time highs.

A notable contribution to the performance of the Strategy in July was our position in AirBoss of America. AirBoss continues to be a beneficiary of substantial contracts as government’s look to procure supplies in order to protect front line healthcare professionals.

Although still elevated from pre COVID-19 levels, Volatility has dropped considerably over the month allowing us to once again purchase option protection as a form of insurance to protect investors capital. We remain cautious moving into the later half of 2020 as geopolitical and election risk remain evident.

The Waypoint All Weather Strategy was up in 0.5% in June vs. 2.4% for the S&P/TSX. Strength in our equities were offset by erosion in the volatility position on the overall index.

It is evident that COVID-19 cases are on the rise as businesses begin to open up. Given the market momentum we have seen over the last few months we are taking a cautious approach. We continue to deploy our volatility strategies in this market given our belief that markets will remain in a range for the next several years.

Over the past 5 years, the S&P/TSX Composite is flat versus the S&P 500 which has gained 44%. Index investors who have favored the US market over Canada have benefited from its superior fundamentals. Specifically, this US index has greater exposure to the high ROE / high margin technology sector, has greater revenue diversification globally and overall higher revenue and earnings growth rates. However, since the drawdown in markets in Q4 of 2018, the correlation between the two markets has been on the rise, reaching a high of 90% in the past 2 months.

The All Weather Strategy decreased in the month of May due to an erosion in the volatility position held on the overall index. This was offset by a positive gain on the risk reversal position held on the Canadian banks. Shopify, Gold and Energy stocks accounted for 75% of the market’s performance during the month. All sectors in which the fund does not hold positions.

The TSX has rallied approximately 30% since the March 23rd low with Information Technology and Materials stocks leading this rebound. Within those sectors, Shopify and the gold miners account for the majority of the appreciation. We recognize this defense tactic given that gold stocks are being potentially viewed as hedges against inflation as well as technology stocks which are benefiting from secular tailwinds –many which have been brought forward by the recent pandemic. The All Weather Strategy avoids resource stocks and therefore is not going to participate in the appreciation of gold securities as well as our fundamental value bias has kept us away from richly valued technology companies in the Canadian market.

One observation that has led to us keeping a high cash balance in the portfolio is the relative performance of the financial sector in the Canadian market. Canadian bank stocks, although off their bottoms, have materially lagged the broader index in this rebound. Indications from our US counterparts suggest that earnings will be impacted in the upcoming quarter. Until we have more visibility on the health of the Canadian consumer and Canadian business in general –we believe this higher than average cash balance is prudent. Bank stocks report towards the end of May at which point we will re-evaluate our positioning.

The Waypoint All Weather Alternative Fund currently holds 30% cash and has approximately 30% equity exposure at current market levels. Further moves downward in the market will bring the fund back into a short position which we will likely use as an opportunity to further reduce fund gross exposure. Additionally, in the case where markets rebound rapidly (central bank intervention, positive news on a vaccine, etc.) we have begun adding a small long position.

Since the start of 2018, we have seen markets fall 10%, rise 20% and now decline almost 10% from their peaks. The result of this move is little profit for Canadian investors. I’m sure this is hard for many to believe given how positive managers were last year after a 20% rise in the market –all but forgetting the previous years decline. Well, it seems we are back to where we started, once again. For those looking for a different path to investment returns, the Waypoint All Weather Alternative Fund should be under consideration.

The All-Weather Strategy performed in line with expectations in January. The Fund’s equity positions gained with the broader market versus the modest decline in the mark-to-market value of our options positions. This period of performance is more in line with our general expectations for the Fund –generating positive equity returns in rising markets less the historically low cost of put protection. One month certainly does not indicate a trend, but we are pleased to see our equities begin to perform after being flat all of last year.

Evidence continues to build that the Canadian market is vulnerable to a domestic slow down. The Fund is positioned to protect capital if such an event occurs. Ironically, investors appear to agree as evidenced by a continued appreciation of stocks in defensive sectors (Utilities, REITs, Staples). The Canadian yield curve remains inverted and general economic growth (measured by GDP) is weak. Valuations for the largest market constituents have disconnected from the market as a whole as investors choose liquidity over fundamentals; we do not believe these disequilibrium’s will persist.

Throughout history, volatility has been a mean reverting asset class. We continue to see exceptional value in these instruments and believe patient investors will be rewarded.

For 2019, the top quintile of the TSX index by market cap outperformed the bottom quintile by over 10%.The magnitude of this divergence can be compared with three prior periods over the past two decades. We observed similar behaviour at market peaks in 2000 and 2008. The other period occurred in 2011 which coincided with a 20% correction followed by a flat market for approximately two years. Although this was an unfavourable outcome for 2019, these divergences tend to occur over the short term and correct themselves throughout the cycle.

We continue to position clients to take full advantage of the attractive spread that exists between the dividend yield of our favourite companies and the cost of a fully insured portfolio.

2019 Monthly Commentaries

- December

- November

- October

- September

Q3 reports missed most investor expectations given the lack of earnings growth across most sectors. In particular, the financials sector struggled with limited loan growth and rising loan loss provisions. The Canadian yield curve remains inverted making it increasingly difficult for banks to improve profitability moving forward. Large layoffs were announced at certain financial institutions with more likely to follow.

The holdings in the All Weather Fund generally posted strong results in Q3. We continue to see value in the smaller and mid capitalized segment of the Canadian market –which has lagged broader indices for 2019. We are entering 2020 with the goal of further concentrating the portfolio to take advantage of these price – value divergences.

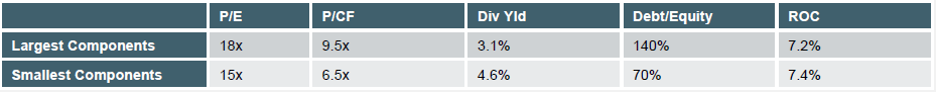

In a recent letter to clients, we mentioned the narrowing breadth that was observable in the Canadian equity market. The relative performance of the largest components of the TSX and the smallest components of the TSX is noteworthy. The divergence is especially apparent over the last 12 months, with the largest components +12% and the smallest -3%.

How do these two portfolios compare today on fundamentals?

This divergence and lack of breadth is often observed at the end of cycles.

We continue to position our clients to take full advantage of the attractive spread that exists between the dividend yield of our favourite companies and the cost of a fully insured portfolio. This allows our investors to profit in a drawdown with a positive carry in the interim.

We continue to be positioned alongside clients to take full advantage of the attractive spread that exists between dividend yield of our favourite companies and the cost of capital preservation (put options). Recent increased in uncertainty, and hence volatility, offers further evidence that our investors will profit in a drawdown and enjoy positive “carry” in the interim. A unique return profile that allows investors to be unconcerned about market timing yet benefit in a market decline.

Thus far in Octobers, for example, our strategy has not been impacted by the market drawdown.

We are also pleased to announce the launch of our first liquid alternative mutual fund (the same investment strategy as our existing Offering Memorandum) – the Waypoint All Weather Alternative Fund will be available shortly on Fundserv using WAY301 for front-end load accounts and WAY303 for fee-based accounts. This will offer investment advisors access to our fund with daily liquidity.

What we continue to believe:

1. The economy is late-cycle and investors need to be protected.

2. The only cheap asset is volatility.

3. There remain attractive opportunities to invest in businesses that we really like and have followed for years.

4. Taken together, this constitutes a unique return profile that allows investors to be unconcerned about market timing yet benefit in a market decline.

As a result, we continue to position our clients to take full advantage of the attractive spread that exists between the dividend yield of our favourite companies and the cost of a capital protection strategy using put options. This allows our investors to profit in a drawdown with a positive carry in the interim.