Waypoint Monthly Commentary

Alternative Yield Fund Commentary

Waypoint's Alternative Yield Fund is designed to generate consistent and stable income along with modest growth while preserving capital. The Fund aims to achieve this by investing across multiple asset classes with differing risk/return profiles, thus generating superior risk adjusted returns in all market environments.

2022 Monthly Commentaries

- December

- September

- August

- June

The last several months, we have seen a tug of war in the markets between macro-optimism and declining real/fundamental data. This is normal behavior in a bear market/transitioning economy. The primary risks facing investors this year have been firstly inflation (and thus interest rates) and secondly earnings or credit risk from slowing fundamentals. Our sense is that the first set of risks are now well priced into the markets – i.e., we believe we’ve seen peak inflation and are nearing terminal rates. Thus, the liquidity/tightening transition, as painful as it has been, is nearly over and digested by the market.

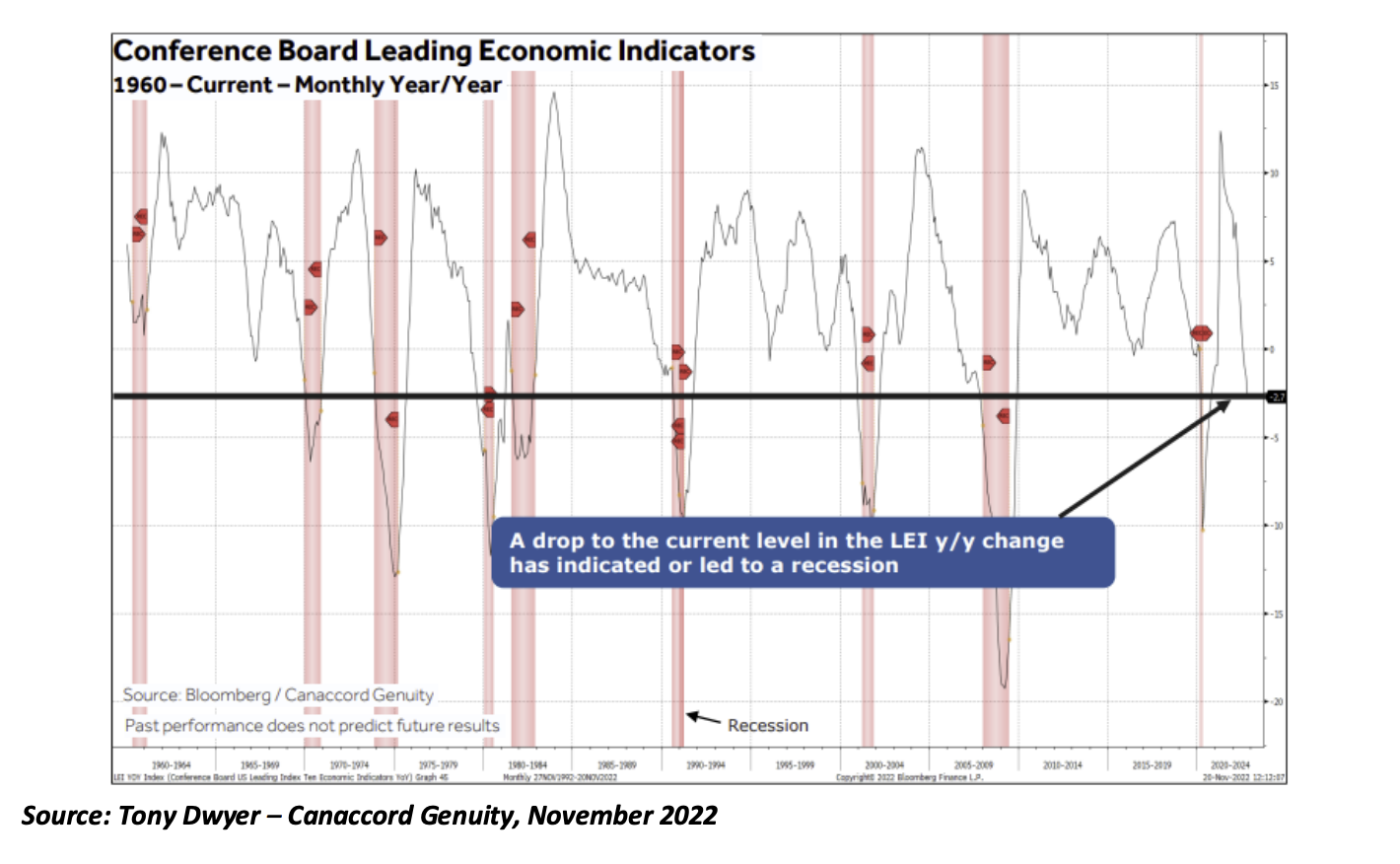

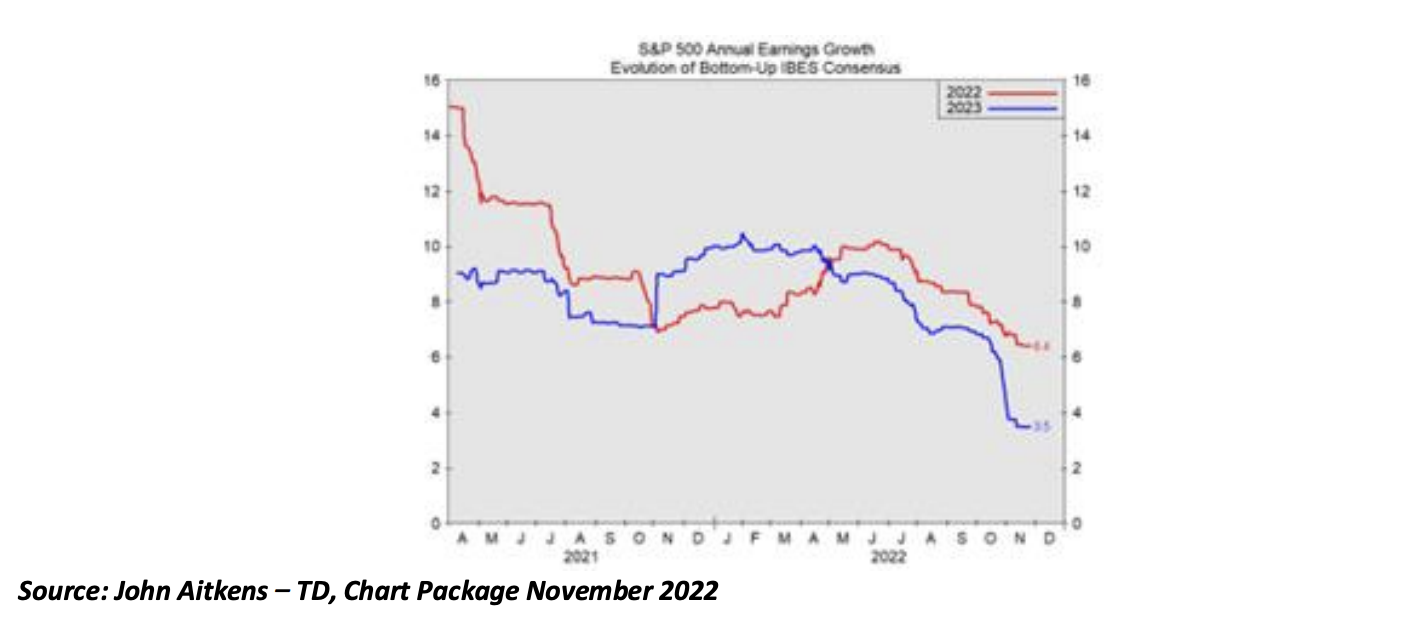

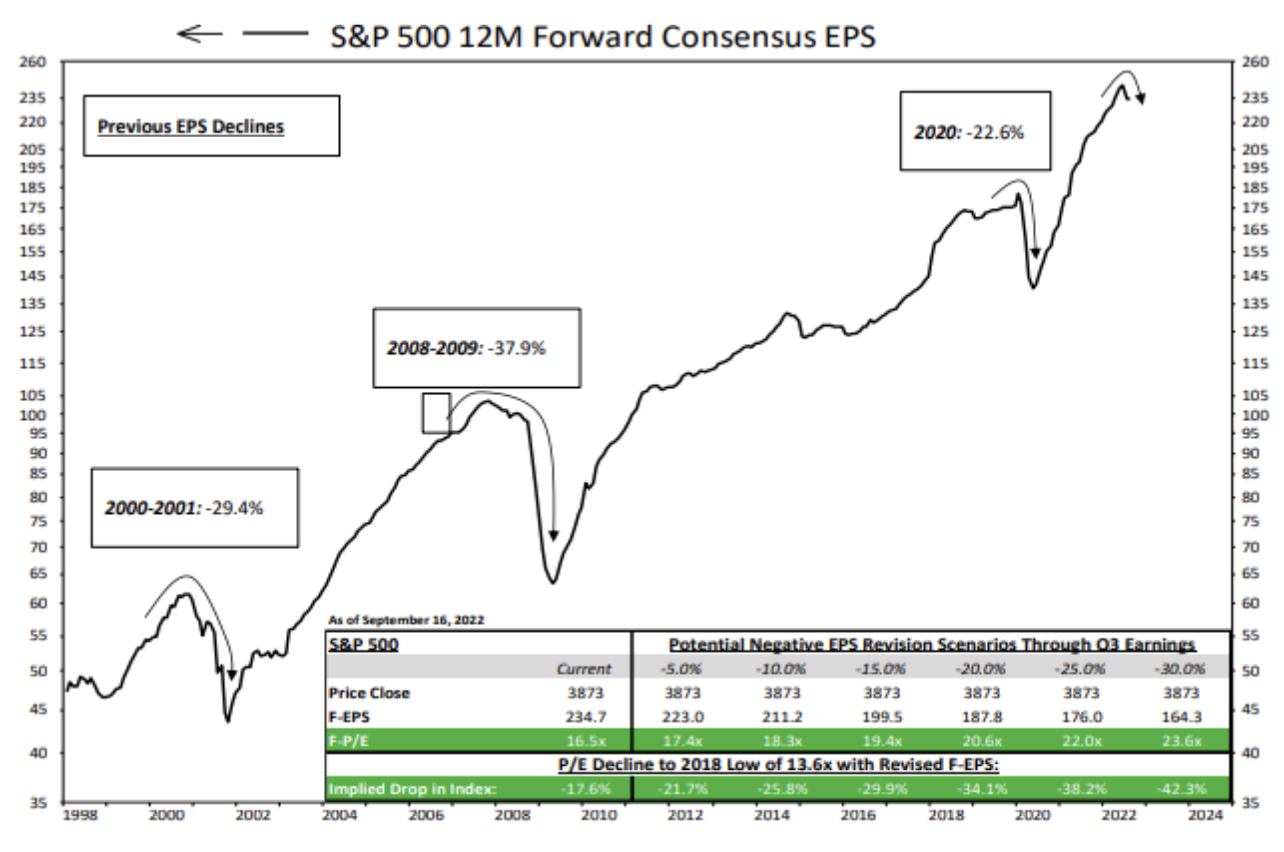

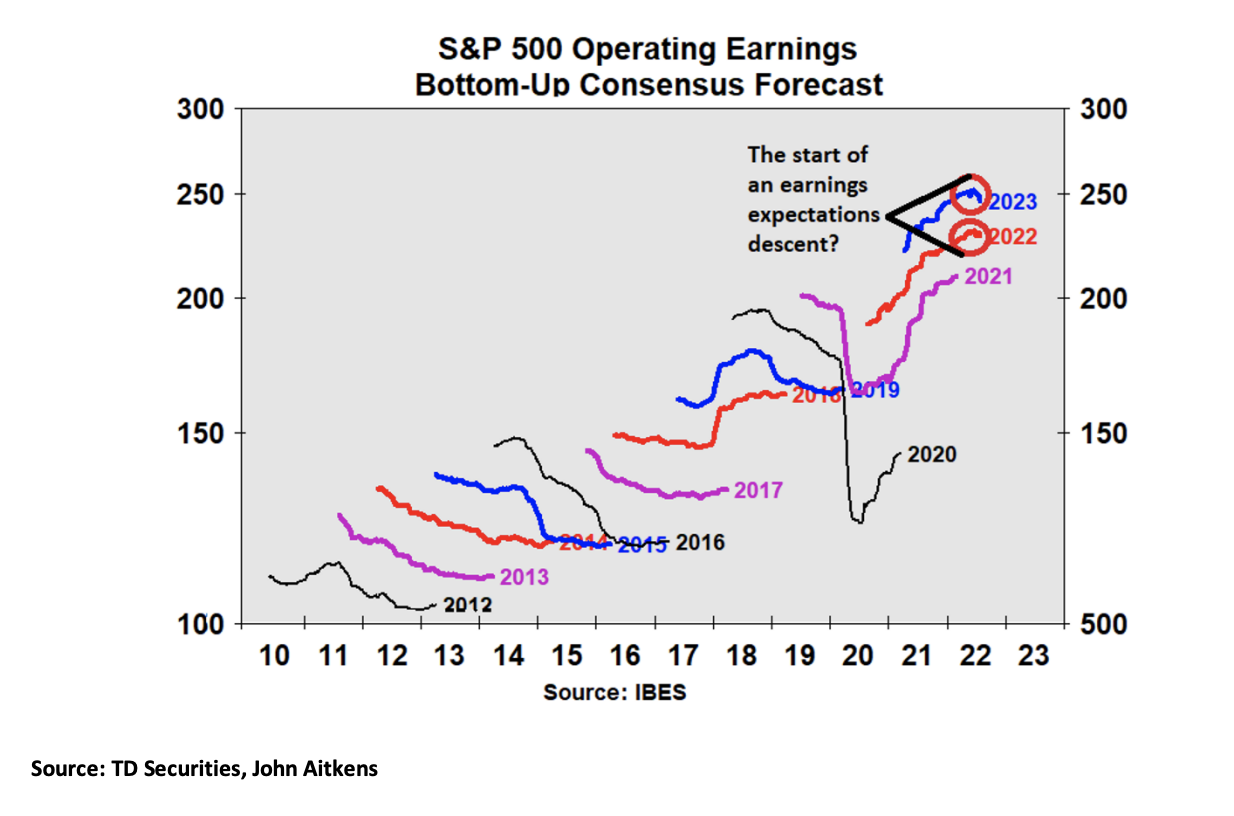

The big issue we see now, and have written about in the past, is the looming earnings and economic slowdown, which is highly probable. The removal of unprecedented liquidity in such a short time frame combined with the current view of needing higher rates for longer to tame stubborn services inflation will surely lead to more negative earnings estimate revisions. Leading economic Indicators have fallen off sharply, yet we haven’t seen this fully reflected in earnings expectations. So, despite the recent positive action in the market, our team is still in the recession camp with the only question being how bad it will it be.

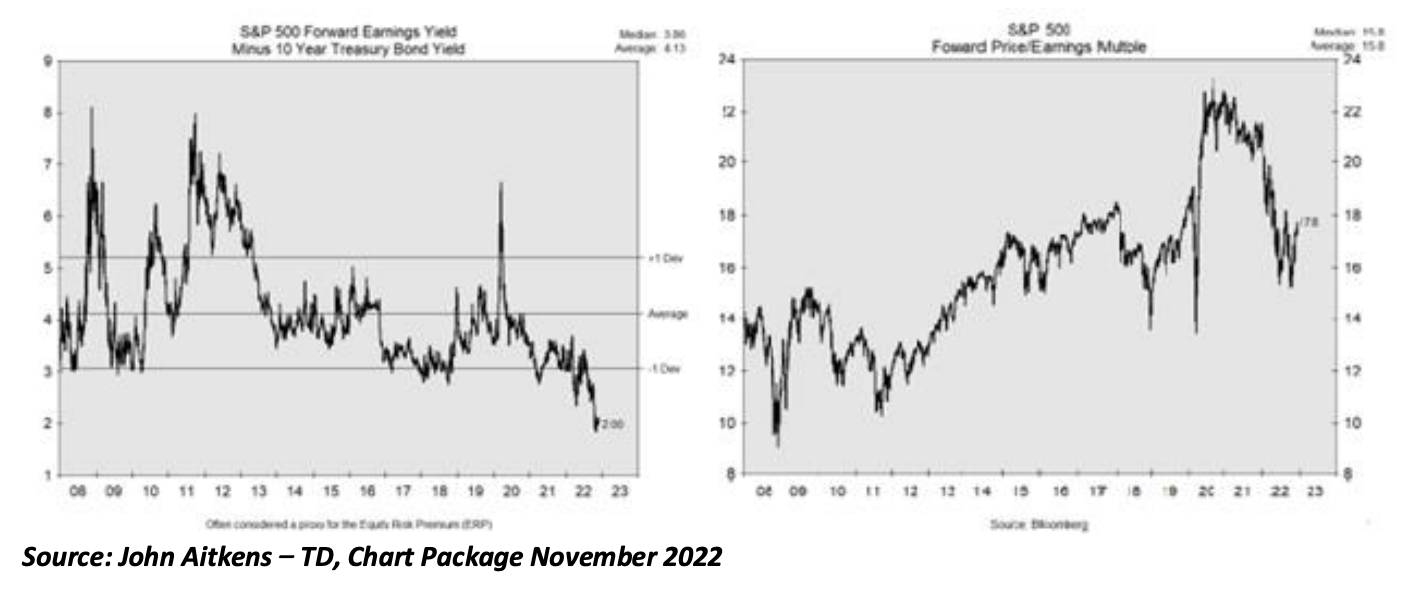

Thus far into the transitionary period, we have only had a modest decline in 2023 earnings expectations and consensus is still looking for mid-single-digit growth in 2023, which we find quite tall given the economic backdrop. We need to witness further estimate reduction and capitulation or some further reduction in overall valuations to properly reflect this reality before we can be wholistically confident in a new cycle taking hold. Take a look at equity risk premiums and valuations historically in uncertain times and where earnings downgrades should be when Leading Economic Indicators roll over this much.

We believe this revision issue will resolve with time, as it always does, in the coming quarterly reporting periods.

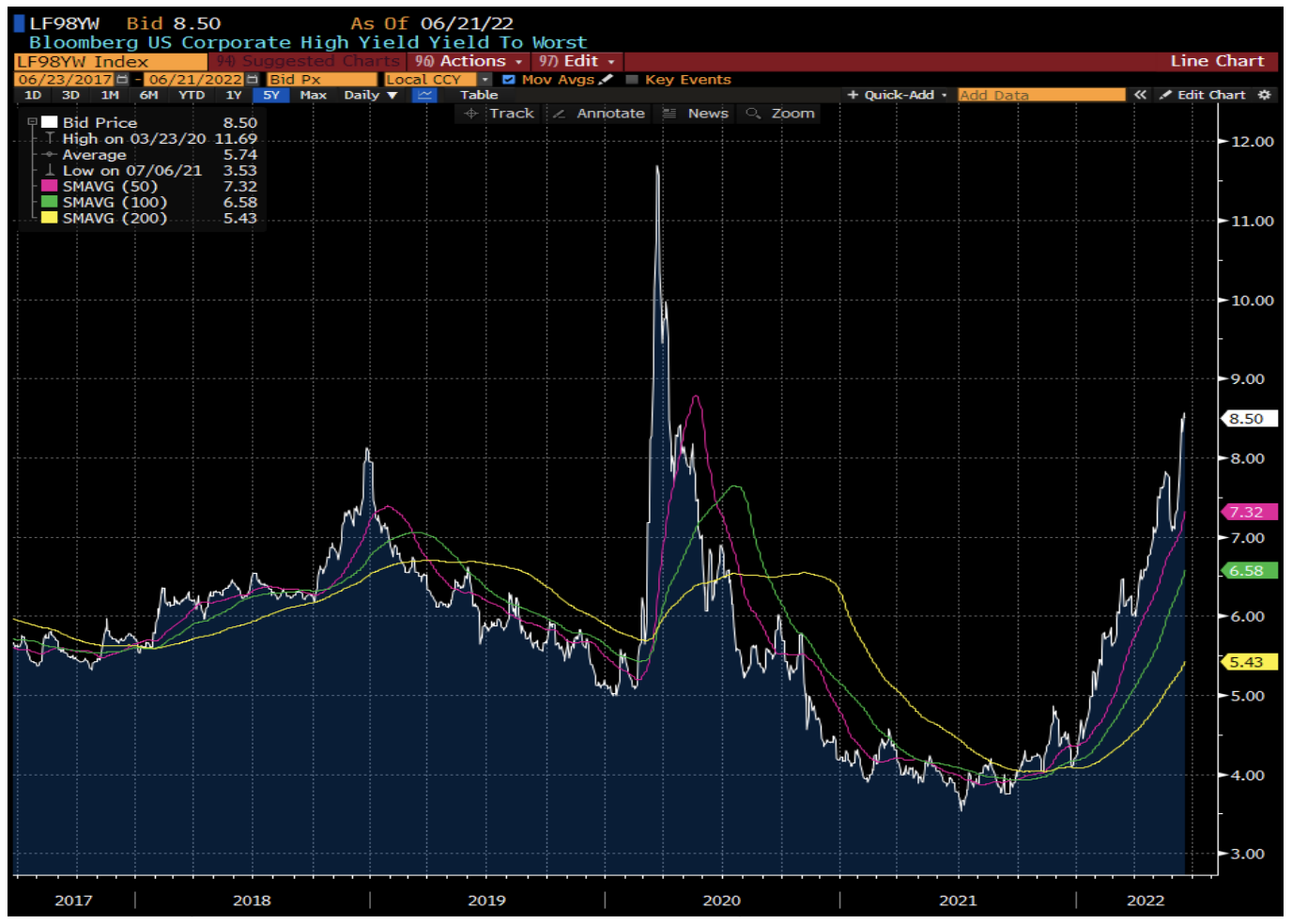

Despite this backdrop, we still see great opportunity to invest in high yield bonds and select higher quality dividend-paying equities. For example, we have identified a note offering from a major North American telco yielding near 9%. Twenty years ago, this same company had capex intensity over 30% and profits margins below 25%. If ever there was a risk of default on its debt it would have been then. Now, the same company has reduced capital intensity below 20% while profit margins have increased to 42%. These types of companies produce highly predictable long duration cash flow streams. Accordingly, we see an extremely low risk of default and an attractive risk versus reward opportunity in holding their bonds. For example, buying this paper at a 9% yield, and at a discount to face value, would provide a low double-digit IRR held to maturity!

We understand many investors are now tempted to invest in GICs since they can collect nearly a 4% coupon without having to stomach the risk of the broader market volatility. While we acknowledge that for the first time in a long time GICs now yield a valuable component of asset allocation (particularly for those investors with a short time horizon and low risk tolerance), investors must remember that markets can bounce quickly and GICs will fail to participate on the upside. Timing the market is incredibly difficult to say the least and staying exposed to the market through a well-diversified portfolio including longer-duration fixed income and dividend-paying securities provides a means to participate in the eventual market upswing. It seems highly unlikely that one can outpace inflation and generate real returns over the long term without benefitting from some capital appreciation. In short, we are getting paid to wait; holding highly liquid securities producing a substantial yield that is comparable to GICs (likely better on a tax equivalent basis) in a recessionary environment, but with capital appreciation potential built in for a recovery.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

A lot has changed over the past month on the margin. September has brought us more worries in the form of a Fed now seemingly content on more rate increases, more pain and recession.

We have been positioned quite cautiously but were aware that we could see some sort of pivot in the Fed’s action by year end. As we feared, the market got a bit of a wake-up call with a onetwo effect of the most recent CPI print and subsequent Fed meeting. Rightly or wrongly, despite a lot of uncertainty, the Fed continues to make it loud and clear that it will continue to hike and remove liquidity from what appears to be an already slowing economy. The action in the bond markets has been telling, with rapid moves higher across the entire curve. We have been in the recession camp for some time now, but our fear was that the market was being overly optimistic by pricing in a soft landing/mild recession, which many pundits had been espousing.

What is apparent is that in addition to the rate hikes already undertaken, which were unprecedented in recent history, the Fed is really boxing itself into another series of increases that will take the terminal rate ~100 basis points higher than what the market had expected. Furthermore, the Fed will hold at those levels for longer or until inflation data come to support otherwise. So, it’s the worst-case trilogy with respect to rates – faster, higher and longer!

Inflation tends to be very sticky, especially when it comes to housing and wages, which are a key contributor to the problem at hand. An intended recession with high unemployment seems to be one of the only tools to actually lower wages and rents and soften demand to match the fixed and muted levels of supply in the post-covid and Ukrainian conflict era.

The economy already feels like it’s worse off than the data would show with forward-looking indicators collapsing. One only has to look as far as the leading economic indicators which are plummeting, strong US$, weak Euro region, falling North American exports, consumer confidence at historic low levels, decreasing business confidence, household savings rates at lows and real disposable income that has been eroded by inflation.

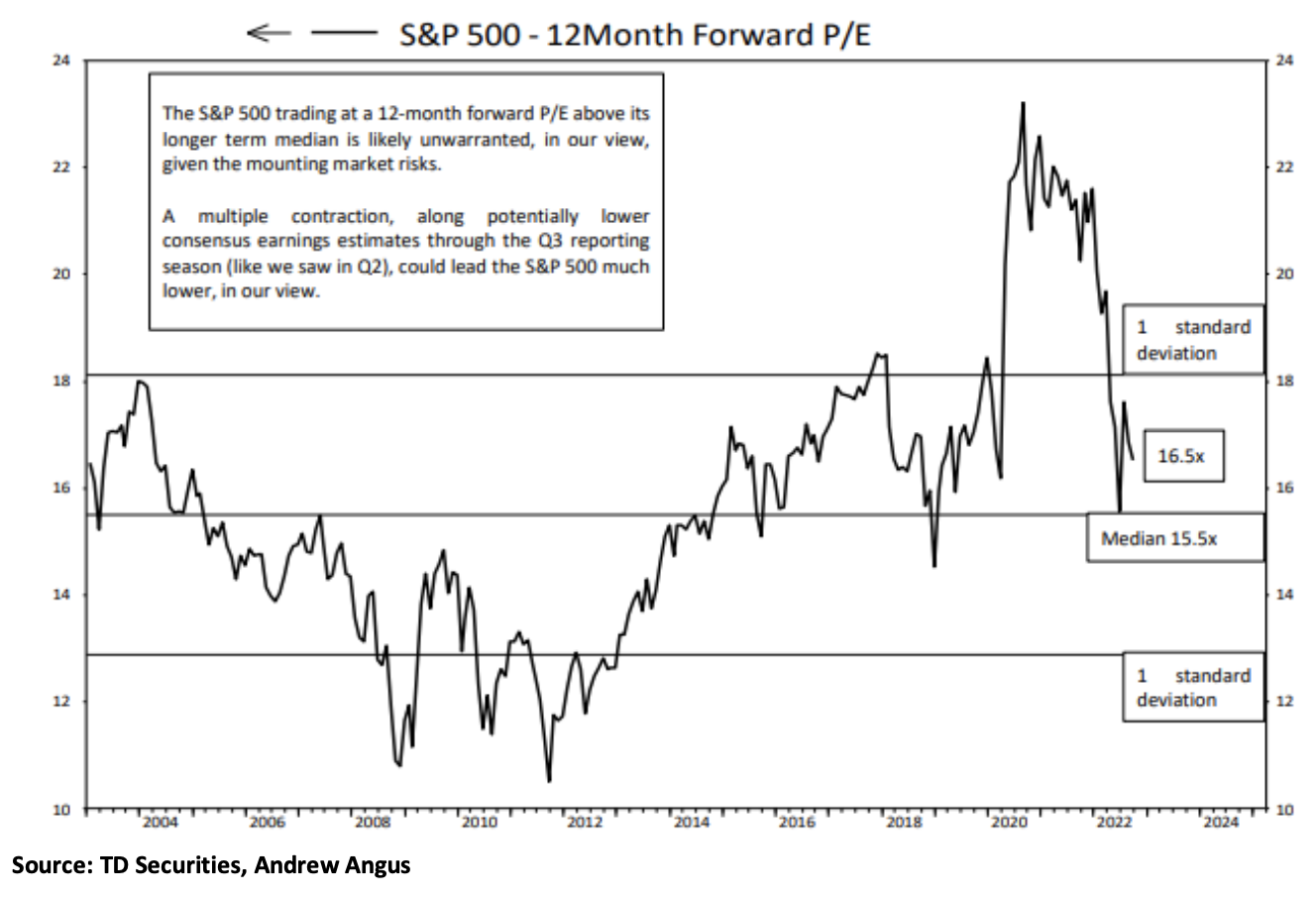

Given this backdrop it should be very apparent that the consensus estimates for 2023 showing 9% growth are off the mark as is the current market valuation of 15.1x earnings (at time of writing). Downward revisions that started in June have a way to go and should possibly show contraction. Valuations should also be lower for this type of economic/market set up. We wanted to highlight a couple of charts that hit home from Andrew Angus at TD Securities showing that 2023 estimates still need to come down quite a bit and that the current valuations still appear too high for the environment we are in.

We have a lot to get through in the final quarter of this ugly year. We are headed into the weakest historical seasonal period with a Fed on a dangerous autopilot stance for at least the next few meetings and tax loss selling is also around the corner.

So how are we navigating these troubled waters? We believe that patience is still the right path, while at the same time we do not recommend one be uninvested. We continue to think cash and conservatism remain the focus. As investors, we’re always performing a balancing act between generating returns and managing risk. Today we think investors should be focusing more on managing risk.

We had already established a position in long-maturity treasuries with the TLT as we expected a flight to safety to occur as the market adjusts to reality and lower estimates and multiples. Now we see opportunity in the front end of the treasury curve as those maturities are very close to fully pricing in the Fed’s terminal rate (which we may or may not get to). Upside/ downside risk looks compelling and the 2yr Treasury is yielding 4.2% (at time of writing). We feel that we can safely collect 4%+ while we wait for inflation to start its descent and the Fed to indicate some sort of pivot. We are hopeful we are near a peak in inflation as we are seeing commodities roll over and the consumer somewhat retrenching on the goods front. When we do see inflation decline, we could see some capital appreciation as the curve begins to normalize. We also prefer the US Treasuries as the US$ tends to do well in a risk-off environment.

So, in summary, we hold decent levels of cash and are employing a treasury barbell approach to generate yield and some potential capital appreciation as we go through what we expect to be a tough fall quarter. We have also continued our put option strategy, which is generating a 7-10% annualized yield on our exposed dollars. We remain positive on some high-yield names, which are looking quite compelling despite the increased risks towards defaults in the overall market as we wait for the equity markets to properly reflect the environment and set up for the next cycle. Finally, for the equites we do own, we remain steadfast in holding companies with predictable, stable businesses and cash flows. We believe in having good exposure here as you can never really time the market and need equites over the long term. High quality dividendpaying companies that rank well in our quants tend to go down less, survive to fight another day, and perform well when the markets rebound. If our goal is to compound our clients’ capital, we must, first and foremost, minimize drawdowns. Accordingly, we are prioritizing our asset allocation in a phased approach.

Phase 1 Treasury barbell + put options to earn attractive yield on our cash – get paid to wait and or called in at compelling levels.

Phase 2 Continue adding to our high-yield bond allocation as we are seeing some compelling

opportunities where spreads and pricing actually reflect the environment we are in.

Phase 3 Add to our dividend-paying equity positions once we feel estimates and valuations have

come in enough.

We are getting paid to wait; holding highly liquid securities producing a substantial yield that is comparable to GICs in a recessionary environment but with capital appreciation potential built in for a recovery. Concurrently, we are maintaining exposure to high-quality bonds and equities as it’s impossible to fully time the market and we seek to ensure we participate in the eventual and critical early upswing.

Over the past month, broad indices have witnessed a significant rally, post a rapid sell-off in the first half of the year. The S&P 500 and NASDAQ, for example, have recovered half of its losses while the more risk/growth-oriented Russel 2000 has recovered nearly 60%. The high-yield market has rallied back a little more than 6% while spreads have tightened by over 100 basis points down to 432 bps. We believe the key driver for the market optimism is the view that we may have finally reached “peak” inflation and any recession would be mild and short in duration. Effectively, the market seems to believe the U.S. Federal Reserve and the Bank of Canada can engineer a “soft landing”. With the latest CPI and PPI reads, and broad commodity complexes including, oil, metals, lumber and other materials rolling over from their highs, as well as a significant build in goods inventories in general, the future view for inflation is more promising than it has been for many months. Although it should be noted that thus far, the path to taming inflation has been primarily driven by demand destruction vs. supply growth. If inflation has truly peaked, one could argue that the bottom may be in for marketable securities as it relates to the risk of central banks raising rates too fast and too high. However, we shouldn’t expect it to be all smooth sailing from here. With the rapid rise in interest rates and all the monetary stimulus that is being removed, the economy will certainly slow. We believe that earnings estimates in general are still quite elevated, showing strong year-over-year growth expectations, despite this tenuous backdrop. We suspect that these forecasts will come down whether we have a soft landing, runof-the-mill recession or something worse. A typical recession historically sees a 10-20% decline in EPS expectations. When the broad indices were at the recent lows, valuations had somewhat reflected the risk of an earnings recession.However, now with the recent rally, one must question if the impending slowdown has been adequately reflected aside from valuations obviously being less compelling. Put another way, at today’s valuations, we believe the risk-reward set up is balanced at best.

With this type of set-up, potential peak inflation, potential central bank pivots in the next 12 months and a strong technical reversal, one can argue that we may have put a bottom in the market. But that doesn’t mean stocks will continue to trend higher from here. Over the next couple of quarters, we expect to see some of the economic slowdown to hit earnings estimates and analyst outlooks, which will result in some volatility as we move forward in the second half of the year.

As we wait for this transition/adjustment to happen, we are cautiously optimistic and continue to find opportunities to leg into the respective markets in which we invest. We continue to look for companies that are trading at reasonable valuations with reasonable growth expectations and built-in resiliency to economic uncertainty.

Positioning:

We continue to hold above-average cash levels to protect against the near-term volatility as we wait for a better overall entry point into our targeted investments. Having said that, there are several high-quality companies that already reflect attractive valuation, reasonable estimates for the current environment, solid balance sheets with decent dividends yields and low payout ratios.

On the high yield side, we are buying positions in stable cash-flowing companies where we find a better risk/reward proposition versus buying their equity.

We have remained active in our options strategy, taking advantage of volatility where and when we can by selling puts on the overall market. Thus far, we have been able to maintain an elevated cash position while earning significant income from selling puts priced 8-10% out-of-the-money but attractively yielding around 10% annualized yields. Although volatility has retreated of late, thus reducing prospective premiums from these derivatives, we will continue to pursue this yield enhancement strategy where opportunity exists.

As mentioned above, we do believe we have reached peak inflation, however; the risk remains that inflation can still stay elevated by historical measures. We think there is enough evidence to show that the overall levels, or at least second derivative, will decline. As we reach peak inflation, we believe rates across the curve may be nearing an apex and the next worry would be a flight to safety as overall estimates roll off as the impending recession is reflected. We have bought a position in the TLT/US, which we think provides a good hedge and/or near-term moneymaking opportunity

We are also not averse to taking on a little bit more duration, while managing credit risk for the fixed income portion of the portfolio at this point. Having said that, we have added a few new positions in some infrastructure names such as TRP, Enbridge, Videotron and GFL.

We believe a recession, or at the very least an earnings slowdown, is forthcoming. It’s easy to see that we may have the opposite of 2015 where the consumer hung in while the industrial slowdown occurred. This time around we have consumer sentiment essentially at all-time lows, wage growth decelerating (well below 5% year-to-date), hiring freezes and firings beginning to percolate, and the savings rate set to return to normal (consumer spending is ~ 5% above normal based on the decline in the savings rate).

With the Fed so far behind the curve in fighting inflation, they have embarked on a tightening path not seen in decades. Liquidity is the fuel in the system, and you simply cannot remove this much fuel this quickly and not expect the engine to slow down significantly.

While valuations of all assets classes in which we traffic have dramatically improved, we think there is a little more adjustment to come. Our best guestimate is that we are about two-thirds of the way through this resetting of valuations across the board. Our biggest worry right now is the slowing economy and the negative estimate revisions that still need to come, even though the market has somewhat discounted this already.

We think we are setting up for a very compelling entry point for both equities and high yield bonds but expect that the next few months will see continued volatility as these adjustments in earnings and valuations materialize.

The average forward P/E multiple on the S&P 500 now sits at 15.7x, below its long-term average of 16.1x. However, given the slowing environment, this perhaps should be even lower. The TSX trades at an even steeper discount to its historical average but is also more vulnerable to a cyclical downturn.

High yield bonds are now yielding on average ~8-9% at the index level, which is presenting some opportunities in certain sectors. We’ve seen a move in base rates hit the asset class and are being selective as credit spreads adjust to reflect the new reality.

Positioning:

We continue to hold above-average cash levels to protect against the near-term volatility as we wait for a better overall entry point. Having said that, there are a number of high-quality companies that already reflect bargain valuation, reasonable estimates for the current environment, solid balance sheets with decent dividends yields and low payout ratios.

On the high yield side, we are buying positions in stable cash flowing companies where we find a better risk/reward proposition versus buying their equity.

We have also been active in our options strategy and taking advantage of the increased volatility by selling puts on the overall market. We are able to keep our cash position while yielding 10% annualized by selling puts that are priced 8-10% out-of-the-money. We continue to favour this yield enhancement strategy and will pursue it as long as the opportunity exists.

We also believe we are near peak inflation, and while it could remain high by historical measures, we think there is enough to show that the overall levels or at least second derivative will decline. On the back of this we should be nearing peak rate rates for this cycle. To that end, we believe that rates across the curve may be nearing a peak and the next worry would be a flight to safety as overall estimates roll off as the impending recession is reflected. We have bought a position in the TLT/US, which should be a good hedge and/or near-term money-making opportunity.