Waypoint Alternative Yield Fund

Investment Objective

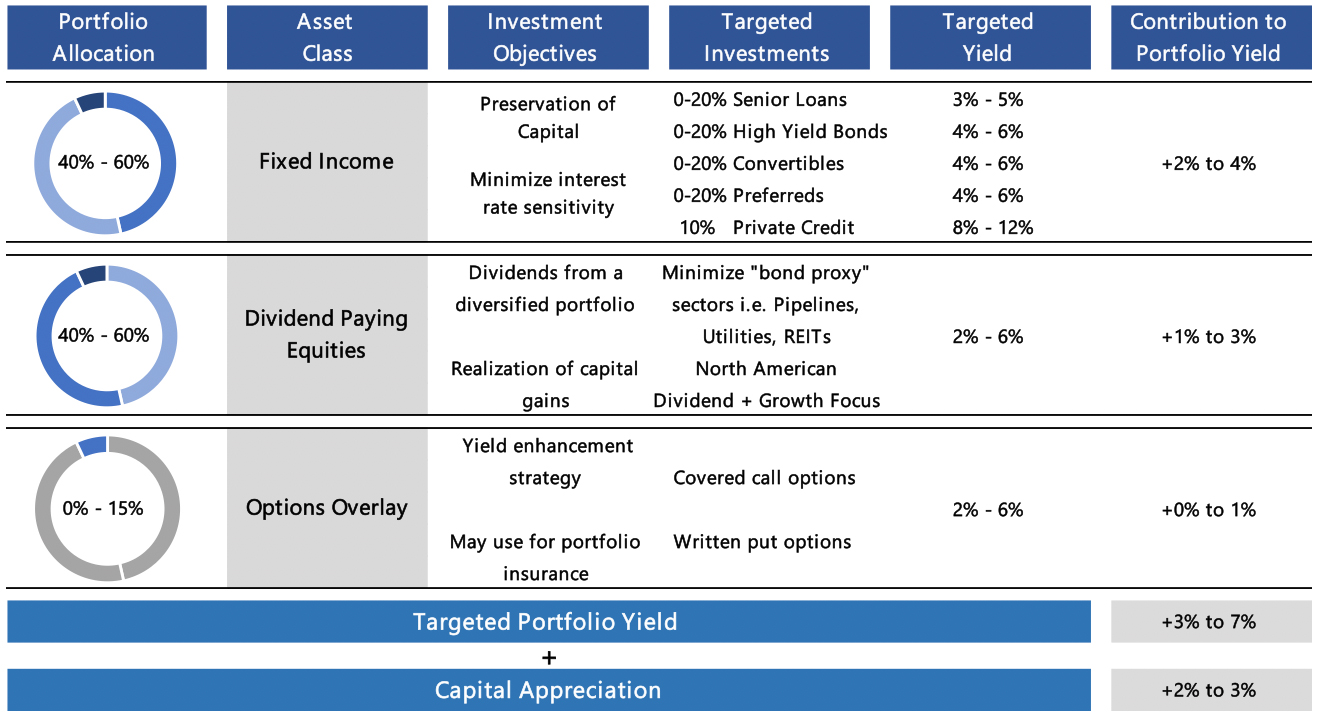

Waypoint's Alternative Yield Fund is designed to generate consistent and stable income along with modest growth while preserving capital. The Fund aims to achieve this by investing across multiple asset classes with differing risk/return profiles, thus generating superior risk adjusted returns in all market environments.

How We Invest

The Portfolio:

We construct an unconstrained portfolio focused on preservation of capital, yield and capital appreciation, in that order, by investing across the capital spectrum in multiple asset classes, allowing us to construct a portfolio with the optimal risk adjusted return potential. We seek to provide stability and yield while limiting interest rate sensitivity by investing across the capital spectrum in floating rate loans, high yield bonds, private credit, convertible securities and preferred shares within the fixed income allocation of the portfolio. The portfolio generates inflation protection, growth and dividend income within its equity component. In general, we aim to invest in high-quality growing companies that trade at reasonable valuations, and focus on businesses that can weather any potential storm or market cycle and appreciate over time. We focus on companies that generate robust and growing cash flow with strong balance sheets that can be used to compound growth, increase dividends, execute prudent share buy-backs and/or undertake accretive acquisitions.

Portfolio Composition Summary: